Private Capital Regional Landscape: Francophone Africa

This report examines the growth drivers in the region’s investment ecosystem and the opportunities emerging across its diverse markets. Between 2012 and H1 2024, Francophone Africa has attracted US$4.8bn across 356 private capital deals.

If you have any questions or comments on this publication, please contact research@avca-africa.org

Read the report

Private Capital Regional Landscape: Francophone AfricaDownload infographics and share key insights from the report

Economic Performance

-

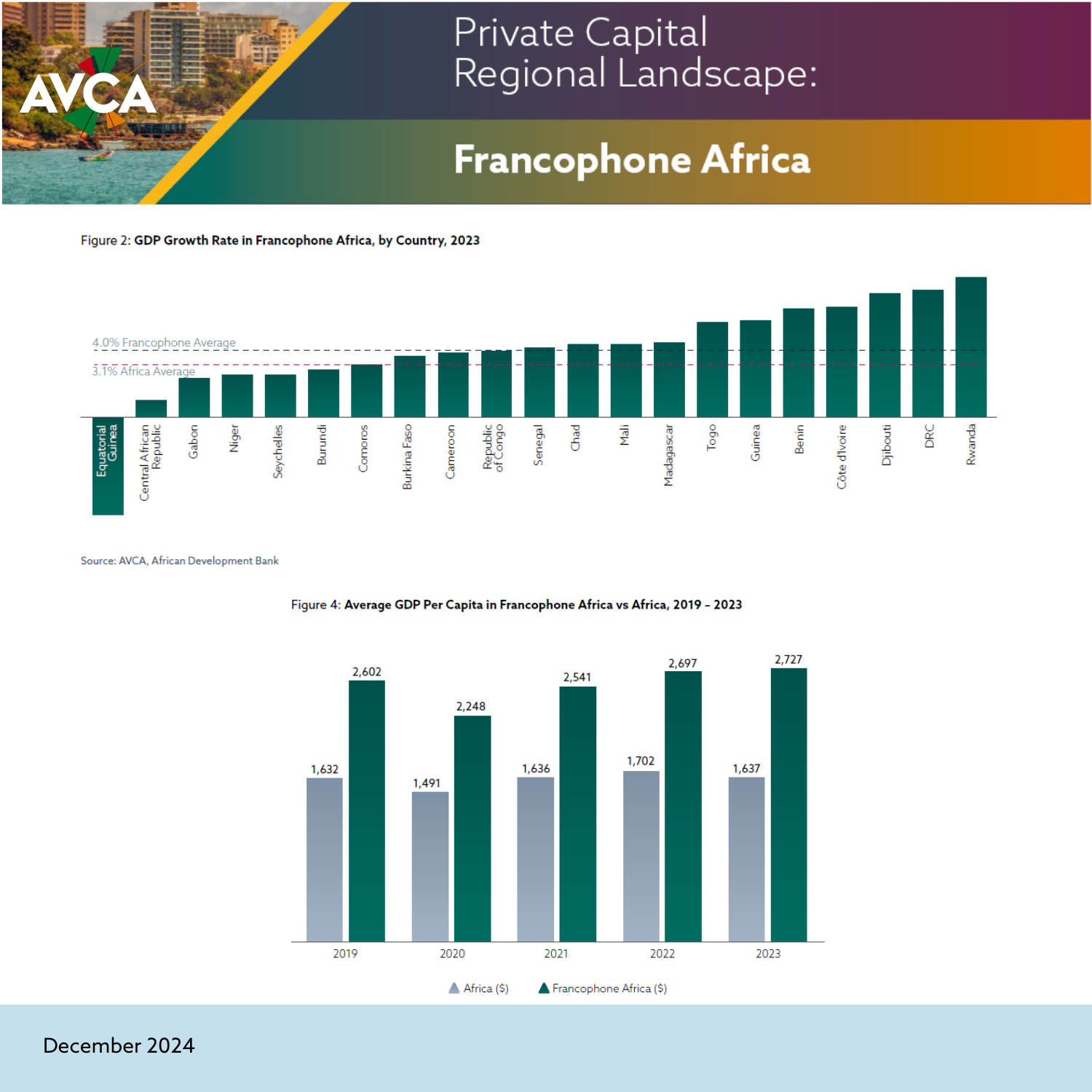

Leading Economies: From 2021–2023, 7 of Africa's top 15 economies were in Francophone Africa, including Benin, Côte d'Ivoire, DRC, Djibouti, Guinea, Rwanda, and Togo.

-

GDP Growth: In 2023, Francophone Africa's GDP growth was 1.3x higher than the African average (3.1%).

-

2024 Outlook: Francophone Africa's economy is projected to achieve a growth rate of 4.8% in 2024, outpacing the 3.8% predicted for the wider continent and demonstrating the resilience and growth potential of this region.

Private Capital Landscape

-

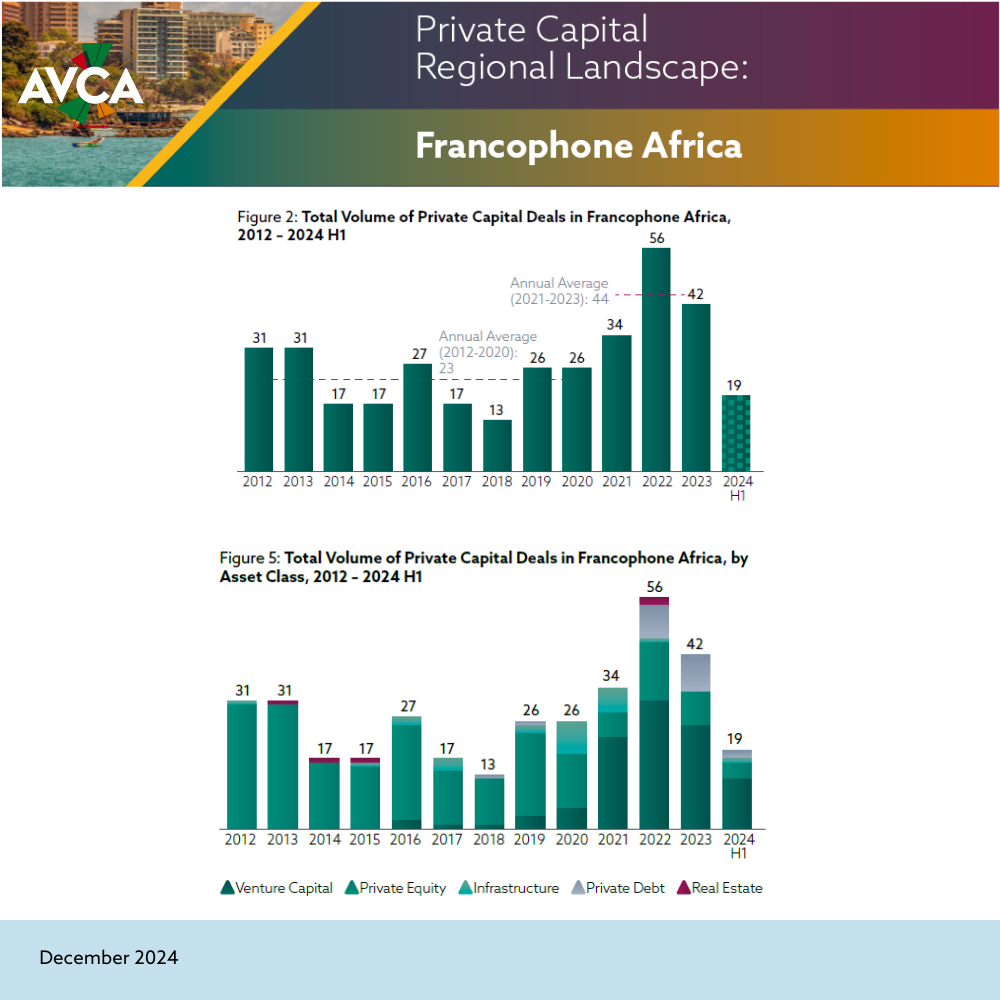

Structural Transformation: Francophone Africa's private capital landscape has undergone a fundamental shift, with average annual deal volume nearly doubling from 23 deals per year (2012–2020) to 44 deals per year (2021–2023).

-

Venture Capital Surge: Venture capital has emerged as a dominant force in the region, growing from virtually non-existent before 2016 to accounting for 60% of deal activity between 2021 and H1 2024 - an eightfold increase that significantly outpaces the continent's twofold growth.

-

Private Debt Deals Rising: Private debt has established itself as a significant investment strategy since entering the region in 2018, with 21 deals totalling US$211mn recorded between 2022 and H1 2024.

-

Strong Exit Activity: The region has seen 76 exit transactions over the past decade, accounting for 13% of Africa's total exit volume.

-

Sector Leadership: Consumer Staples, Financials, Consumer Discretionary, and Industrials dominate investment volume, capturing 68% of all investments since 2012. In terms of deal value, Industrials, Utilities and Financials take the lead, capturing 85% since 2012.

-

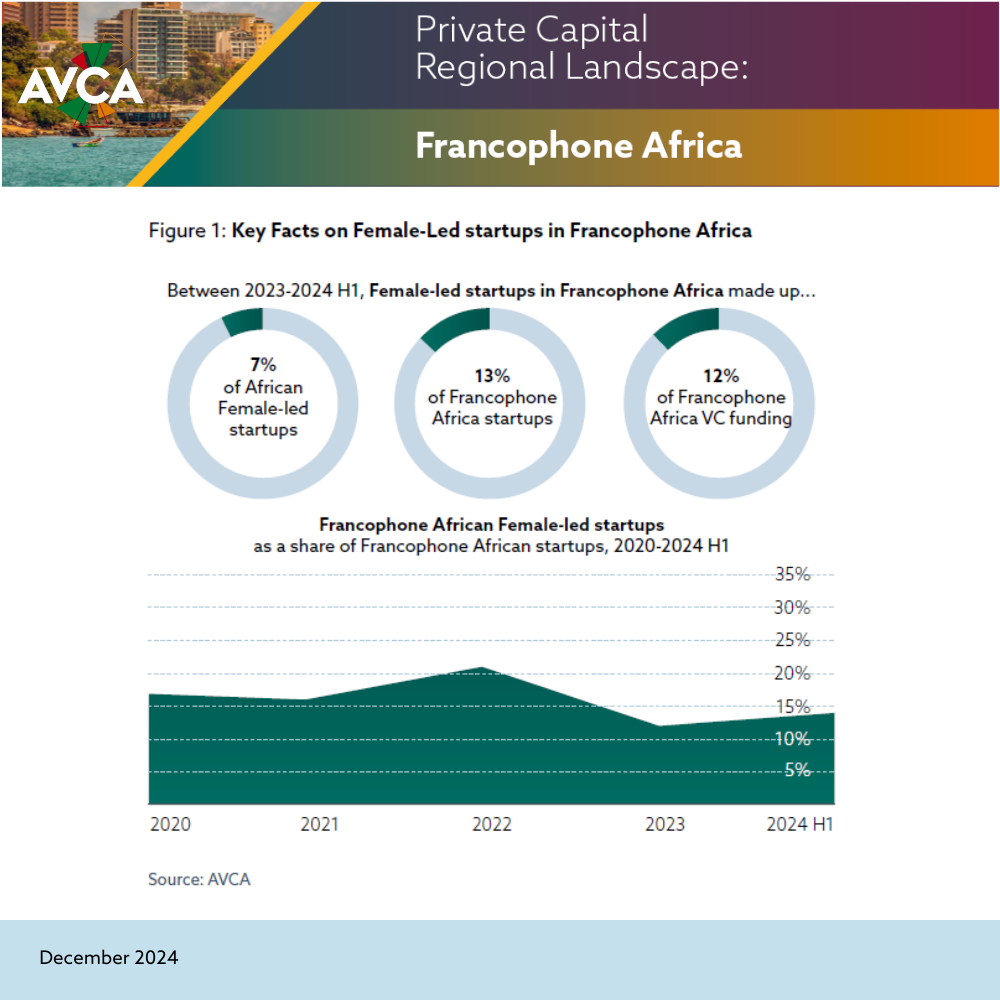

Gender Diversity: Female-led startups in Francophone Africa accounted for 16% of deal volume, surpassing the continental average of 14%. In 2020, they captured 37% of deal value, mainly driven by Kasha’s US$3.6mn Series A. The share of deal value for female-led startups grew from 1% in 2021 to 18% in H1 2024.

Regulatory and Technological Advancements

-

Regulatory Advancements: The introduction of supportive regulations like Senegal's Startup Act and Investment Codes in Côte d'Ivoire (2018), Rwanda (2021) and Benin (2022) have played a pivotal role in fostering a favourable investment climate.

-

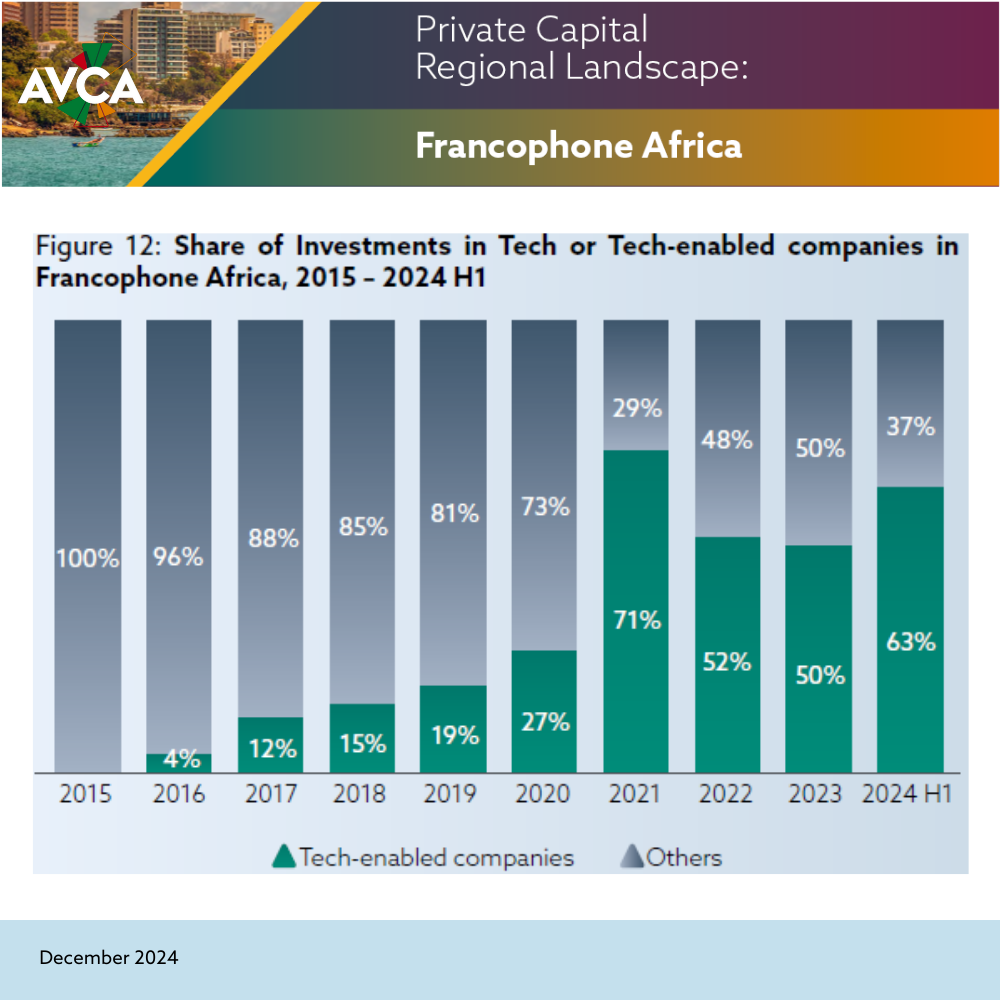

Technology Disruption: Technology-enabled companies drove 57% of deal volume from 2021 to H1 2024, with Financials emerging as a clear leader. The sector's transformation has been particularly dramatic, with FinTech activity accounting for 80% of deal volume between 2020-H1 2024.