Private Capital Investment in Africa’s Infrastructure

Download the public report

Key Findings

Understanding the Context – Africa’s Infrastructure Financing Gap

Despite hosting 18% of the world’s population, Africa receives only 5% of global infrastructure investment, emphasising the need for increased private sector involvement. This disparity underscores the urgency of mobilising private capital to bridge Africa’s infrastructure gap and support sustainable development.

- Sub-Saharan Africa invests only 3.5% of GDP in infrastructure annually, far below the 7.1% required to meet the UN Sustainable Development Goals. Closing this gap could boost GDP growth by an estimated 2% annually, boosting job creation and improving lives.

- Africa faces an annual infrastructure financing gap of US$100bn for basic needs, expanding to US$181bn–US$221bn to achieve the SDGs.

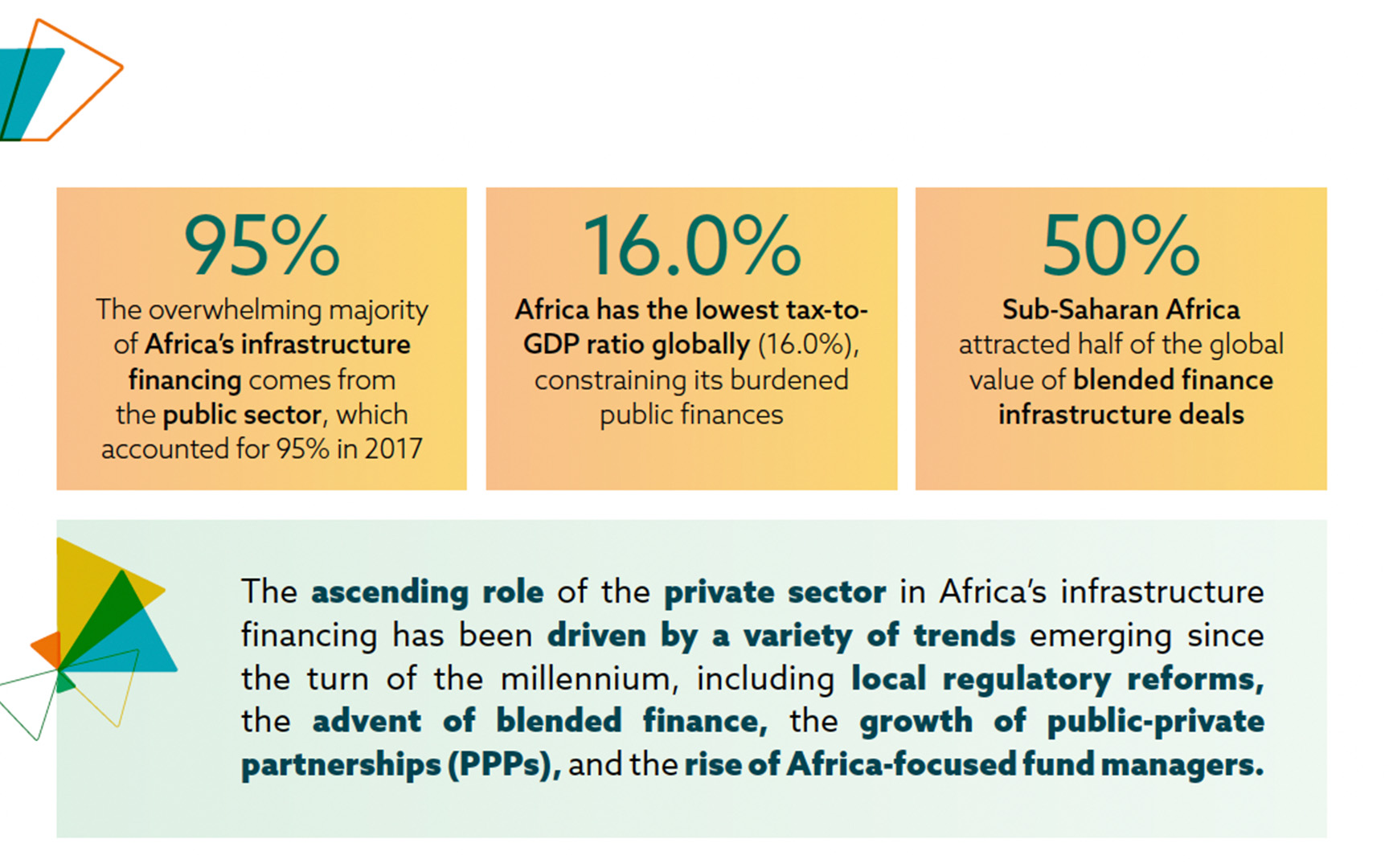

- Africa’s tax-to-GDP ratio of 16%—the lowest globally—limits public funding capacity, as 95% of infrastructure financing comes from the public sector.

Member-Only Access

AVCA Members can access an extended version of the report through the AVCA Platform.

The Private Capital Landscape

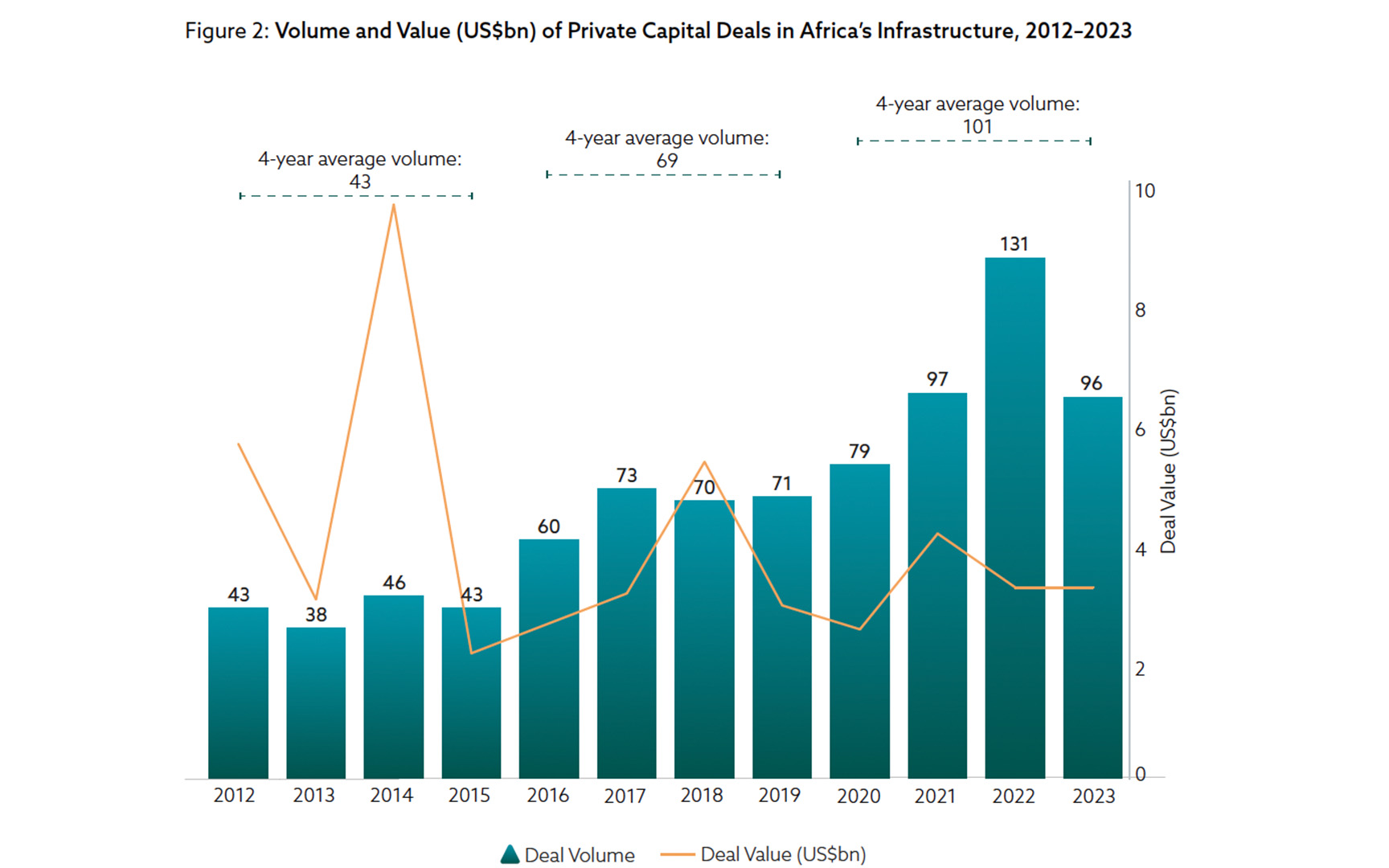

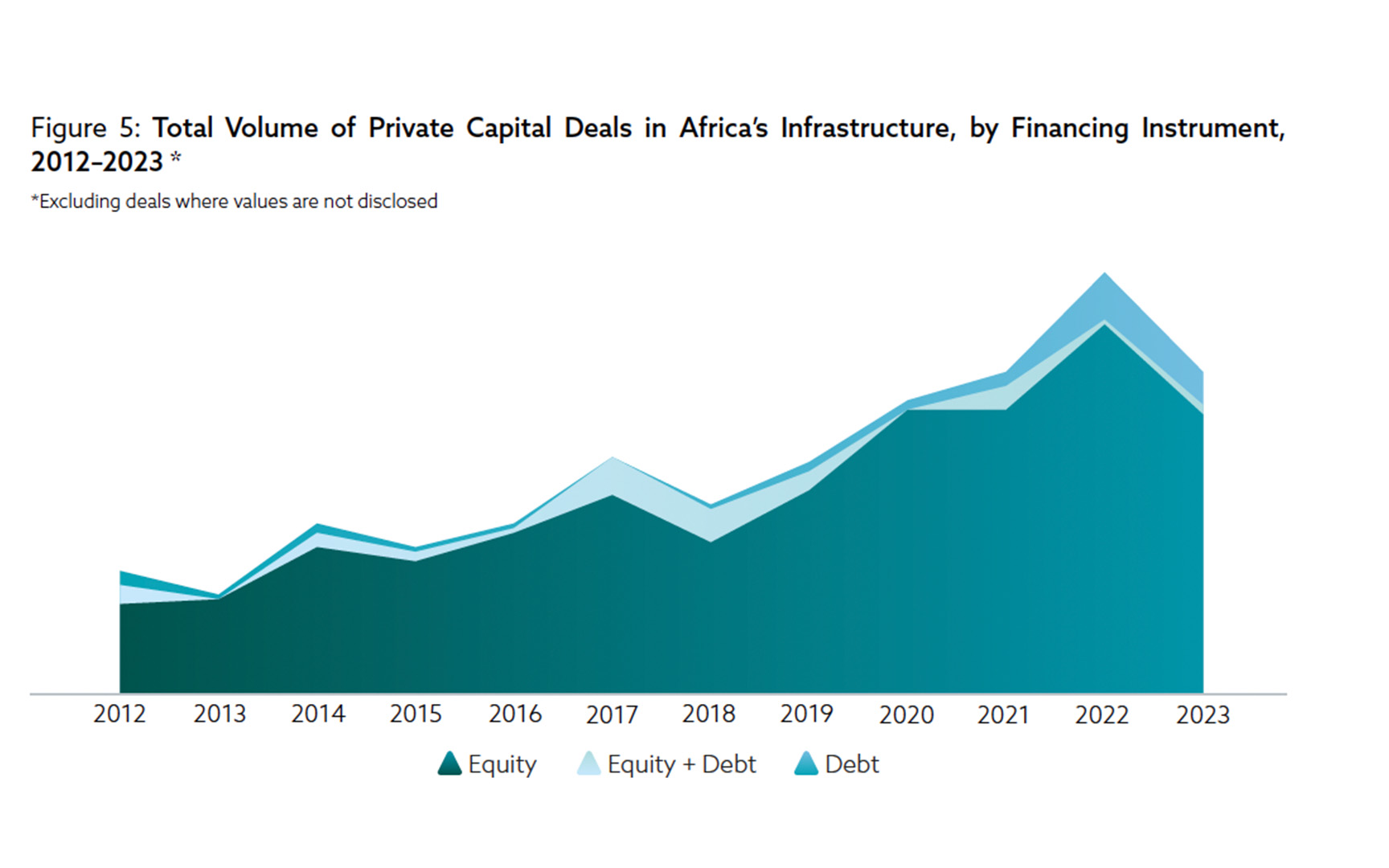

Private capital deal volume more than doubled between 2012 and 2023. Annual deals increased from an average of 43 (2012–2015) to 101 (2020–2023), reflecting growing investor confidence. While 73% of deals fell below US$50mn, supporting crucial smaller-scale projects, 16 megadeals above US$500mn captured US$19.4bn—demonstrating capacity for large-scale projects.

- Regulatory Reform and Blended Finance: Targeted regulatory reforms and blended finance have been crucial in attracting private capital to African infrastructure. Between 2013–2022, Sub-Saharan Africa attracted 41% of the volume and 50% of the value of global blended finance infrastructure deals, with the catalytical capital committed mobilising an equal proportion of private capital.

- Financing Instruments: Equity dominated private capital financing (88% of deal volume), highlighting robust return potential but underscoring the need for infrastructure debt markets.

- Strategic Focus: Energy and Telecommunications & Digital Infrastructure captured 81% of deal value (US$38.2bn), addressing critical power and connectivity gaps.

- Healthcare Innovation: Healthcare emerged as the second-most active sector (30% of deal volume), with pandemic-driven investments catalysing long-term sectoral growth.

- Education: Despite representing 10% of Africa’s infrastructure financing gap, education attracted US$1.1bn across 94 deals, highlighting the potential for growth in EdTech and other education-related infrastructure.

- Transportation: Transport infrastructure represents 73% of Africa’s financing gap, presenting untapped potential in mobility and logistics. Investment in transport infrastructure lags, with US$4bn deployed across 46 deals.

- Regional Dynamics: Southern Africa led in deal volume (27%), while North Africa attracted the highest deal value (US$9.8bn). Multi-region deals reached US$15.2bn, indicating growing infrastructure integration across Africa.

Sustainable Infrastructure

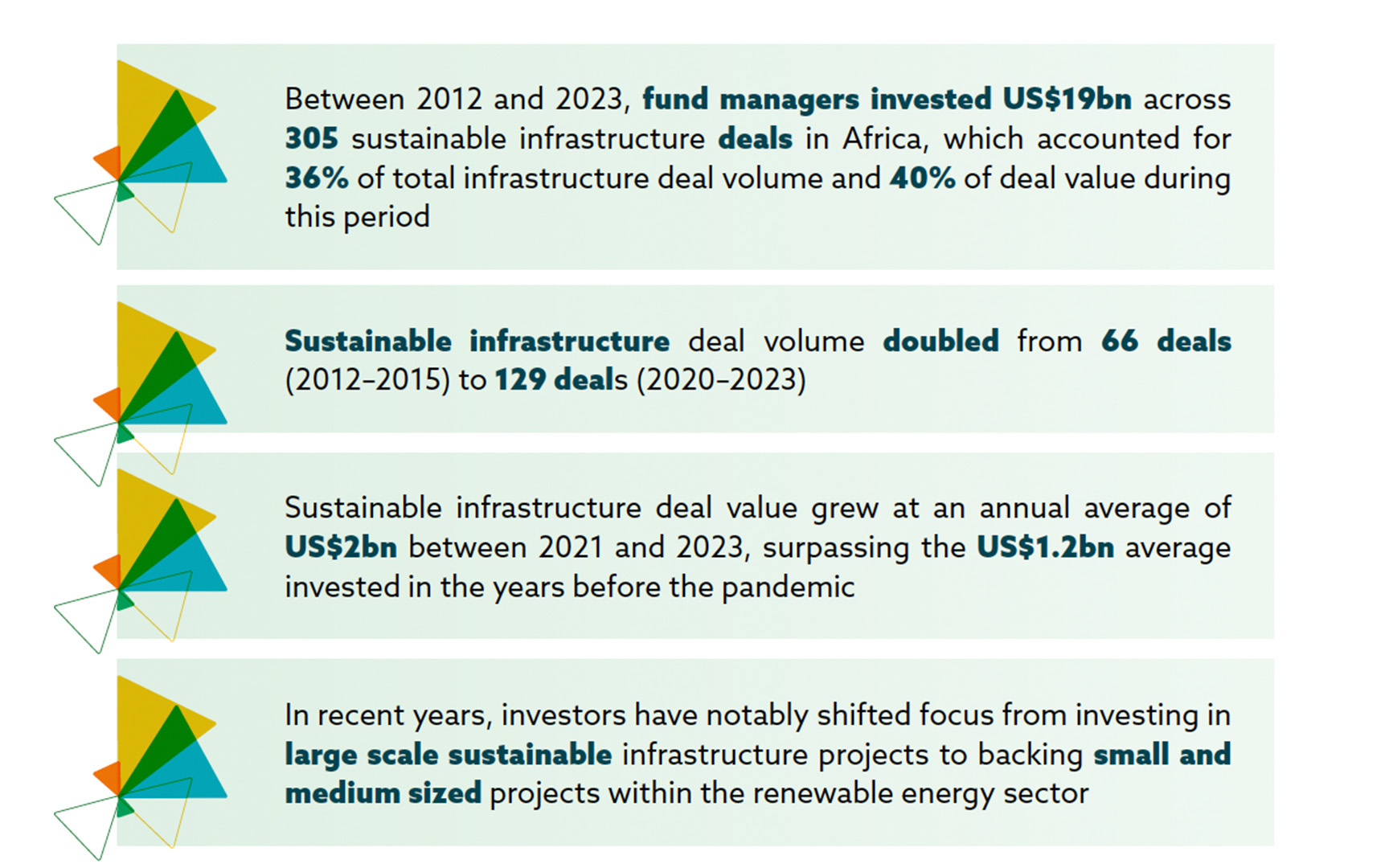

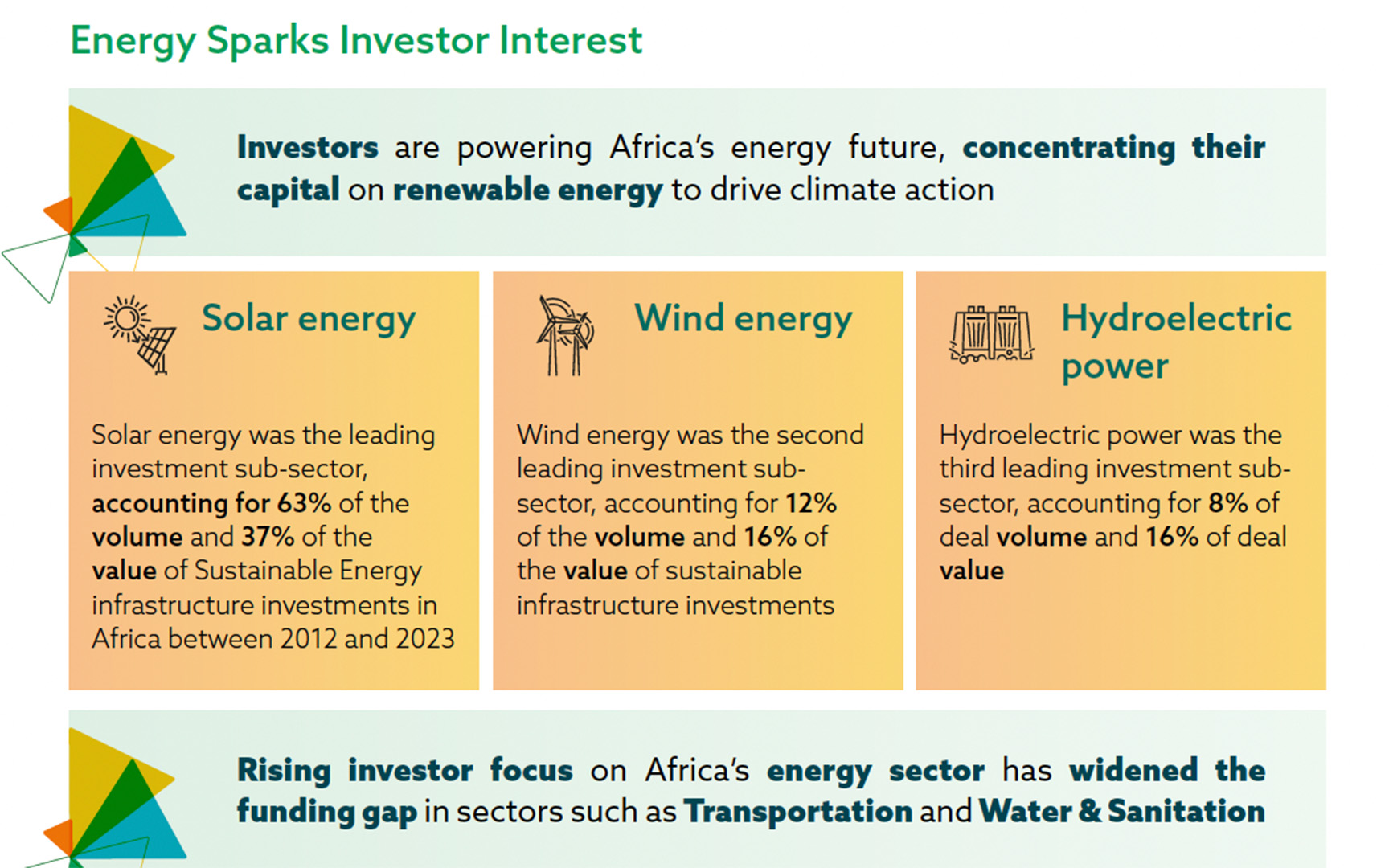

Sustainable infrastructure investments totalled US$19bn across 305 deals, representing 40% of total infrastructure deal value between 2012 and 2023. Solar energy dominated sustainable deals (63% of volume), followed by wind (12%) and hydroelectric (8%), demonstrating Africa’s potential to leapfrog traditional energy infrastructure.