African Private Capital Activity Report 2024

Download the public report

Key Findings

AVCA Members can access an extended version of the report through the AVCA Platform.

Africa in the Global Context

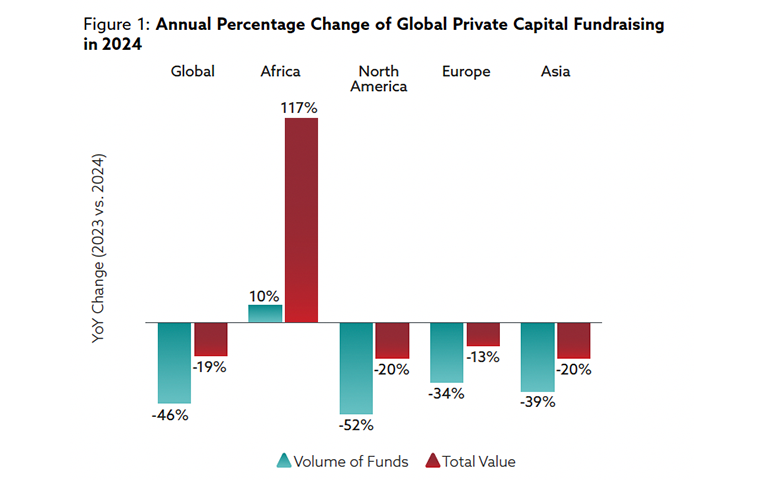

The global private capital landscape showed signs of recovery in 2024, with Africa demonstrating notable resilience despite its smaller market size.

- Fundraising against the tide: Amid a varied global fundraising environment where performance differed by region, African fundraising more than doubled to US$4.0bn across 22 funds. This strong performance came as global private capital fundraising fell 19% YoY, with steeper declines in North America and more moderate contractions in Europe and Asia.

- Bucking global trends: While most regions globally experienced declines in deal volume in 2024, Africa bucked this trend with an 8% YoY increase, positioning it alongside Latin America (24% increase) as one of only two regions to show positive growth in transaction activity. This resilience in deal flow came despite a challenging macroeconomic environment that saw declining volumes across North America (-4%), Europe (-2%), and particularly Asia (-12%).

- Relative exit resilience: Africa recorded the highest annual growth in private capital exits globally in 2024, rising 47% YoY. This renewed momentum comes despite persistent global liquidity challenges and exit-to-investment ratios remaining below historical norms, with Africa at a modest 0.13x.

Fundraising

-

Specialisation trend: 2024 marked a watershed moment in African private capital as Generalist fundraising fell to zero for the first time in 13 years, while specialised Infrastructure and Private Equity funds each secured 30% of total fundraising value (US$1.2bn each). This shift reflects investors' growing preference for targeted strategies.

-

Local capital emergence: African investors have become increasingly significant players, growing their commitments from US$171mn to US$639mn between 2022 and 2024 (14% to 19% of total fundraising). While Development Finance Institutions remain the largest contributors (US$1.4bn - 42% of total value), their proportional share has decreased from 59% in 2022, as local Pension Funds, Corporate Investors and Insurance Companies boosted their collective allocations by 11.7x.

The Investment Landscape

The investment landscape in 2024 showed mixed but generally positive trends, with changing patterns across deal sizes and asset classes.

- Volume growth amid value stabilisation: African private capital recorded 485 deals in 2024 (8% YoY increase), marking the second-highest deal volume on record, while total investment value declined slightly to US$5.5bn (7% YoY decrease).

- Shifting deal landscape: For the first time in 10 years, deals below US$50mn represented more than 50% of total deal values, while average deal size declined to US$15.2mn from US$18.2mn in 2023 and large deals (US$250mn+) fell by 85% YoY.

- Divergent asset class performance: Private Equity experienced a remarkable resurgence, with deal volume surging by 51% YoY and value increasing by 25%, while Private Debt maintained strong momentum (10% YoY increase in volume, 36% in value). Venture Capital continued its gradual adjustment with modest declines in both volume (7%) and value (10%).

- Dry powder levels: At the close of 2024, Africa-focused fund managers held an estimated US$10.3bn in dry powder, equivalent to two years of deployment at current rates. Two-thirds of this capital is held by Private Equity and Infrastructure funds, with 71% concentrated in recent vintages, signalling a strong near-term investment pipeline.

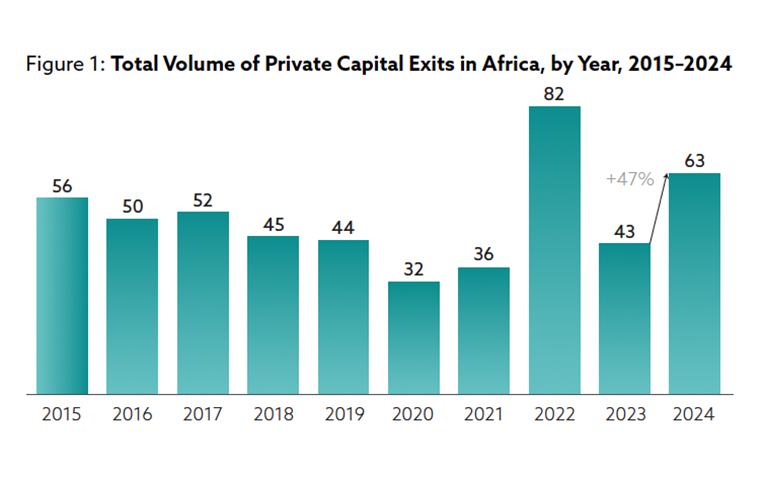

Exits

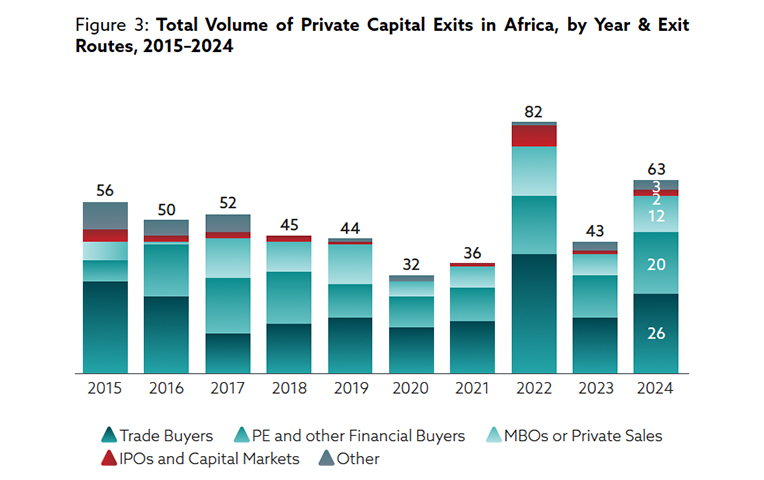

Market recovery: Africa's exit activity rose by 47% YoY, with 63 exits recorded in 2024, pushing activity beyond pre-pandemic levels and marking the highest volume since 2022. This revival reflects improving economic conditions and increasing pressure on fund managers to return capital.

Evolving exit strategies: While Trade buyers remained the primary exit route (41% of total volume), their share has declined for two consecutive years as Secondaries transactions rose marginally to comprise 32% of exits, slightly above the 5-year average of 29% and Management Buyouts saw a 71% YoY increase.